Personal property depreciation calculator

Personal Property Depreciation The following are useful life estimates for common household items. Identify the propertys basis.

Straight Line Depreciation Calculator And Definition Retipster

There are many variables which can affect an items life expectancy that should be taken into consideration.

:max_bytes(150000):strip_icc()/desk-writing-work-pen-office-business-676191-pxhere.com-ff806b26e1734bde82038a304564daf8.jpg)

. So get your free home condo or renters insurance quote or feel free to give us a call at 800 841-2964. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. You can also use the Add Item button to.

Inventory your belongings and estimate their value with our personal property calculator. The calculator allows you to use. For instance a widget-making machine is said to depreciate.

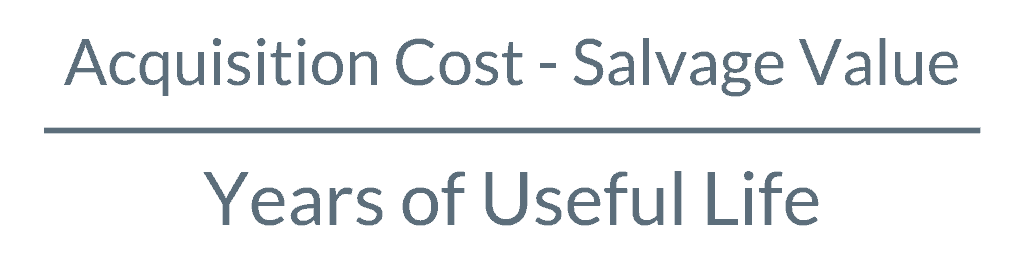

In this method depreciation is calculated according to the effect so it is important to predict the most realistic effect. Per the IRS you are allowed an annual tax deduction for the wear and tear of property over the course of time known as Depreciation. Here is how to use a property depreciation calculator step-by-step.

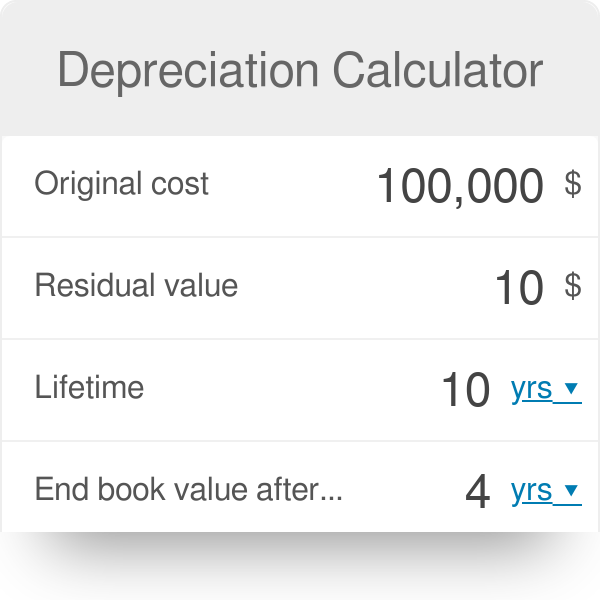

This personal property calculator is always worth coming back to every once in. The MACRS Depreciation Calculator uses the following basic formula. C is the original purchase price or basis of an asset.

The effect of this method is to write off most of the cost of. It provides a couple different methods of depreciation. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods.

Lists of common items are in categories to jog your memory. ITEM DEPRECIATION ITEM DEPRECIATION Antiques Collectibles no depreciation. D i C R i.

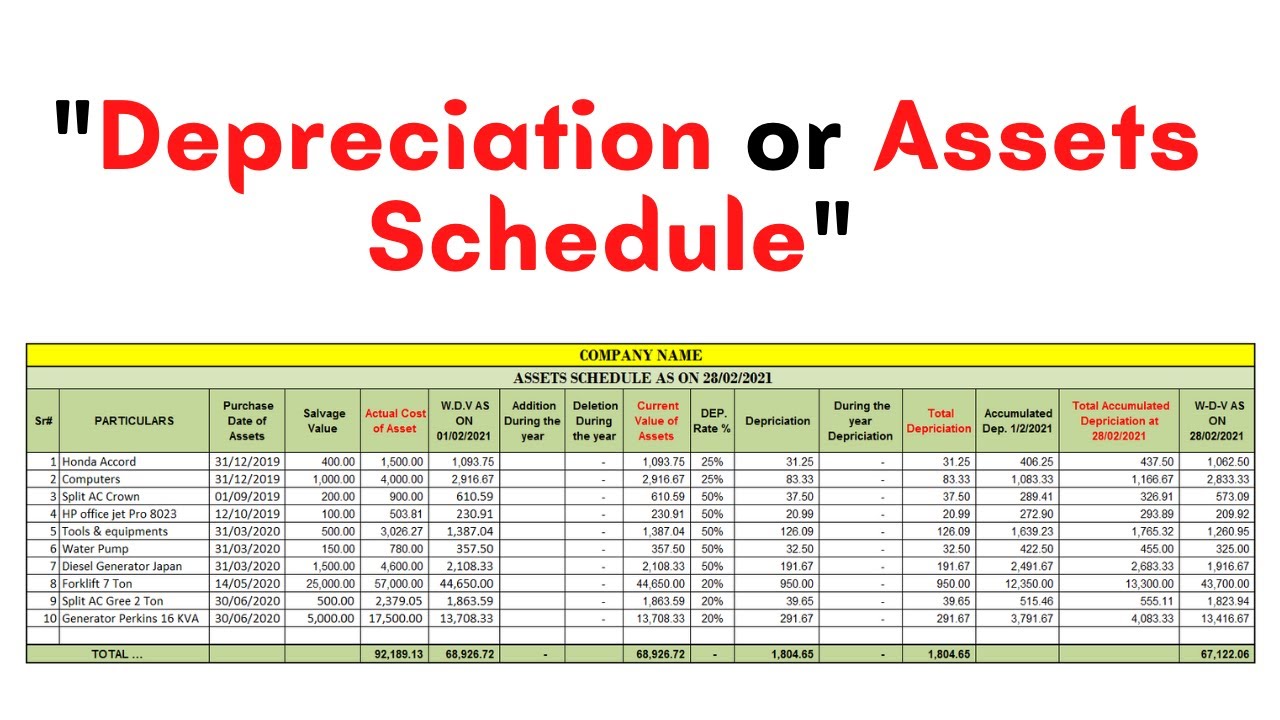

This depreciation calculator is for calculating the depreciation schedule of an asset. The calculator should be used as a general guide only. This is the section 179.

The calculator should be used as a general guide only. First one can choose the straight line method of. Where Di is the depreciation in year i.

Determine your asset depreciation method. As a real estate investor. There are many variables which can affect an items life expectancy that should be taken into consideration.

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Also includes a specialized real estate property calculator. Separate the cost of land and buildings.

You can elect to recover all or part of the cost of certain qualifying property up to a limit by deducting it in the year you place the property in service.

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

How To Use Rental Property Depreciation To Your Advantage

How To Prepare Depreciation Schedule In Excel Youtube

Declining Balance Depreciation Calculator

1 Free Straight Line Depreciation Calculator Embroker

Depreciation Schedule Formula And Calculator Excel Template

Skzi1zpptvapjm

Macrs Depreciation Calculator Irs Publication 946

Depreciation Schedule Formula And Calculator Excel Template

Straight Line Depreciation Calculator And Definition Retipster

Depreciation Calculator Depreciation Of An Asset Car Property

Depreciation Calculator Definition Formula

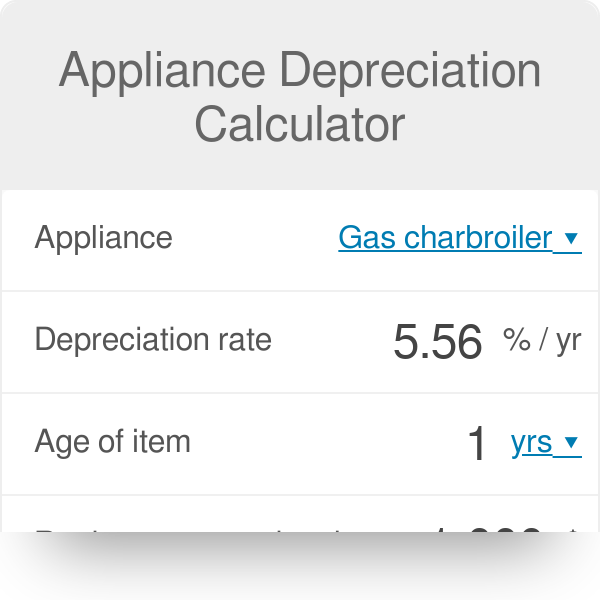

Appliance Depreciation Calculator

:max_bytes(150000):strip_icc()/desk-writing-work-pen-office-business-676191-pxhere.com-ff806b26e1734bde82038a304564daf8.jpg)

What Is The Tax Impact Of Calculating Depreciation

Depreciation Schedule Template For Straight Line And Declining Balance

Macrs Depreciation Calculator Straight Line Double Declining

Free Macrs Depreciation Calculator For Excel